Europe Orphan Drug Market Outlook 2018

The concept of rare diseases and the idea that a special attention needs to be given to this sector has been taking shape in Europe since the 1990s. ever since then the political aspects and initiatives related to orphan medicinal products have been emerging at both the EU level and at the level of member states individually.

Many member states in the EU have led the way during the 1990s in the space of orphan medicinal products, the result of which took the shape of the first European legislative text concerning rare diseases called the Orphan Medicinal Product Regulation. This Regulation was adopted in 1999 and came into effect in 2000.

Europe is the second largest market for orphan drugs. In the European region, rare disease is considered to be a priority area and research in this field is given high importance by the EU Framework Programmes for Research and Technological Development (FP) ever since the early 1990s. Increasing the utilization of scarce resources and coordinating research efforts are the basic factors which have been responsible for success in the European rare diseases market. However, the absence of an exhaustive rare disease classification, standard terms of reference and a harmonized regulatory requirement, has always been a challenge in this region, which is currently impacting the global sharing of information, data and samples which would boost the research further.

The orphan drugs enjoy significant competitive advantages in the market owing to the market exclusivity period after the drug has been authorized. Through this clause, the manufacturer of orphan drugs is given a monopoly status in the market because according to the law, no other company is allowed to market the orphan drugs during the exclusivity period. Additionally, this monopolistic power is further strengthened with the fact that no other alternative health technology exists for many orphan drugs.

“Europe Orphan Drug Market Outlook 2018” research report by KuicK Research comprehensive insight on following developments related to Europe orphan drug market:

- Europe Orphan Drug Market Overview

- Orphan Drug Designation Criteria

- Market Specific Reimbursement Policy & Regulatory Framework

- Europe Orphan Drug Pipeline by Phase, Indication & Originator

- Marketed Orphan drug List by Indication & Brand Name

- Key Issue to be Addressed

- Competitive Landscape

1.1 Orphan Drug Defined

1.2 Rising Popularity of Orphan Drugs

2. WHY SHIFT FROM NON ORPHAN TO ORPHAN DRUGS?

2.1 Exhausting Product Pipelines

2.2 Profitability of Orphan Drugs

2.3 Increasing R&D Investment

2.4 Role of Economic Incentives

2.5 Patent Protection & Market Exclusivity

3. EUROPE ORPHAN DRUG MARKET OUTLOOK

3.1 Orphan Drug Designation Criteria

3.2 Market Overview

3.3 Europe Orphan Drug Reimbursement Policy

4. EUROPE REGULATORY FRAMEWORK FOR ORPHAN DRUGS

4.1 Committee for Orphan Medicinal Products

4.2 How to Apply for Orphan Designation in Europe

4.3 Marketing Authorization & Market Exclusivity

4.4 Transferring An Orphan Designation To Another Sponsor

4.5 Mandatory Submission Of Annual Report On Development

4.6 Incentives For Micro, Small And Medium-Sized Enterprises

4.7 Fee Reductions For Designated Orphan Medicinal Products

4.8 Procedure for Orphan Designation & Incentives for R&D (Regulation (EC) No 141/2000)

5. EUROPE ORPHAN DRUG PIPELINE INSIGHT BY PHASE & INDICATION

5.1 Preclinical

5.2 Phase I

5.3 Phase I/II

5.4 Phase II

5.5 Phase II/III

5.6 Phase III

5.7 Preregistration

5.8 Registration

6. MARKETED ORPHAN DRUGS IN EUROPE: BRAND NAME & INDICATION

7. KEY ISSUE TO BE ADDRESSED

7.1 High Initial Investment

7.2 Clinical Study Hurdles

7.3 Regulatory Hurdles

7.4 Distribution Challenges

8. COMPETITIVE LANDSCAPE

8.1 Genethon

8.2 Prosensa

8.3 Shire

8.4 AOP Orphan

8.5 Orphan Europe

8.6 Pfizer

8.7 Teva Pharmaceutical

8.8 Genzyme Corporation

8.9 Glaxosmithkline

8.10 Merck

8.11 Novartis Pharmaceuticals

Figure 2-1: Orphan v/s Non-Orphan Drugs -Phase II to Launch Clinical Development Time

Figure 2-2: Probability of Regulatory Success of Orphan v/s Non Orphan Drugs

Figure 3-1: Europe Orphan Drug Market (US$ Billion), 2012-2018

Figure 3-2: Europe Share in Global Orphan Drug Market, 2012 & 2018

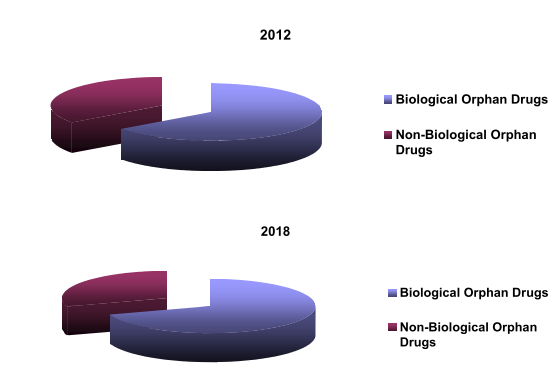

Figure 3-3: Biological & Non Biological Orphan Drug Segment (%), 2012 & 2018

Figure 3-4: Biological & Non Biological Orphan Drug Market (US$ Billion), 2012-2018

Figure 5-1: Europe - Orphan Drug Development by Clinical Phase (%), 2014

Figure 5-2: Europe - Number of Orphan Drug by Clinical Phase, 2014

Figure 5-3: Europe – Number of Suspended & Discontinued Number of Orphan Drug, 2014

Figure 5-4: Europe - Number of Discontinued Orphan Drug by Clinical Phase, 2014

Figure 5-5: Europe - Number of Suspended Orphan Drug by Clinical Phase, 2014

Figure 7-1: Orphan Drug Regulatory Hurdles

Figure 8-1: Genethon Drug Pipeline Chart

Figure 8-2: Prosensa Drug Pipeline Chart

Figure 8-3: Shire Drug Pipeline Chart

Figure 8-4: Genzyme Drug Pipeline Chart

Europe is the second largest market for orphan drugs. In the European region, rare disease is considered to be a priority area and research in this field is given high importance by the EU Framework Programmes for Research and Technological Development (FP) ever since the early 1990s. Increasing the utilization of scarce resources and coordinating research efforts are the basic factors which have been responsible for success in the European rare diseases market. However, the absence of an exhaustive rare disease classification, standard terms of reference and a harmonized regulatory requirement, has always been a challenge in this region, which is currently impacting the global sharing of information, data and samples which would boost the research further.

Europe Orphan Drug Market (US$ Billion), 2012-2018,_2012-2018.png)

The global orphan drugs market is classified into biological orphan drug segment and non-biological orphan drug segment, with the former accounting for more than 65% share. With the development of orphan drugs being led by biotech companies Genentech was the first biotech company to enter the market. The company released its growth hormone products—Protropin and Nutropin—in 1985, which were the first of its kind.

Biological & Non Biological Orphan Drug Segment (%), 2012 & 2018

The biological segment of the orphan drugs market was worth USD xx billion in 2012 and is most likely to grow at a CAGR of xx% to reach USD xx billion by 2018. The non-biological orphan drugs segment was estimated to be approximately worth USD x billion in 2012. This segment is expected to record a CAGR of xx% to reach close to USD x billion by 2018.

Biological & Non Biological Orphan Drug Market (US$ Billion), 2012-2018

,_2012-2018.png)

The significant growth in the biologics segment is in a part because the biological orphan drugs are at present less vulnerable to generic (biosimilar) erosion as compared to small molecules. This implies that the economic value of these biological orphan drugs would continue even after the end of the patent expiration.

Increasing R&D Investment

It has been estimated that Europe has witnessed more than 70 therapies for rare diseases being approved since 2000, when the European Commission introduced incentives to encourage the development of these drugs. The share of R&D for orphan medicinal products development as a proportion of total biopharmaceutical industry’s R&D has been increasing significantly over the years. This is strengthened by the fact that almost all companies which have been set up recently to develop orphan medicinal products have their extensive R&D plants and staff located in the European Union. This shows the significance of the region and its level of attractiveness.

Additionally, the investment in R&D by the European companies for developing orphan medicinal products has increased by more than 200%, while the total number of employees in these companies has recorded an increase of more than 150% since 2000. With the long durations of lead times in the biopharmaceuticals industry for R&D projects, it is most likely that the EU Regulation for Orphan medicinal products would have a significant impact in the coming years.