Directed Energy Weapons Market by Technology (High Energy Lasers, High-power Radio Frequency, Electromagnetic Weapons, Sonic Weapons), Platform (Land, Airborne, Naval, Space), Application, Product, Range and Region - Global Forecast to 2027

A directed energy weapon (DEW) is a ranged weapon that damages its target with highly focused energy, including laser, microwaves, and particle beams. Potential applications of this technology include weapons that target personnel, missiles, vehicles, and optical devices. In US, the Pentagon, Defense Advanced Research Projects Agency (DARPA), the Air Force Research Laboratory, US Army Armament Research Development and Engineering Center, and the Naval Research Laboratory are researching directed-energy weapons and railguns to counter ballistic missiles, hypersonic cruise missiles, and hypersonic glide vehicles.

A DEW is a future weapon system that emits highly focused energy for target destruction. The potential applications of this advanced technology include anti-personnel weapon systems, missile defense systems, and disabling of lightly armored vehicles.

A key driver propelling the growth of the global DEW market is the defense of chemical, biological, radiological, and nuclear materials so that civilian lives and the national security of a country can be preserved. DEW equipment like lasers, radiation detectors, and biosensors are being used to defend against chemical, biological, radiological, and nuclear (CBRN) emergencies. Training fire department personnel, police, and paramilitary forces to use these weapons will help them be more effective in performing their roles. These factors will lead to the purchase of different types of DEW and result in the growth of the global DEW market during the forecast period.

Based on technology, high energy laser segment is projected to lead the directed energy weapons market during the forecast period

Based on technology, the directed energy weapon market has been segmented into high energy laser (HEL), high-power microwave (HPM), electromagnetic weapons, and sonic weapon. HEL segment witness significant growth during the forecast period. A laser is a device that emits light through a course of optical amplification based on the stimulated emission of electromagnetic radiation. A laser is different from other sources of light as it emits light that is coherent. Spatial coherence allows a laser to be focused on a tight spot, enabling applications such as directed energy weapon systems. A large amount of focused energy is delivered by high-energy lasers to a faraway target at the speed of light, thereby causing structural and incendiary damage. High-energy laser systems use photons, or light particles, to carry out military missions and civil defense. This directed energy technology enables the detection of threats, tracking during maneuvers, and positive visual identification to defeat a wide range of threats, including unmanned aerial systems, rockets, artillery, and mortars.

Based on application, military segment to witness higher growth during forecast period

Directed energy weapon market divided into military and homeland security. The directed energy weapons market for the defense segment is estimated to witness a high growth rate as compared to the homeland security segment. The need to protect against different types of threats, which may require a qualitatively different response and force, has fueled the growth of the directed energy weapons market. Technological upgrades of existing products and new product launches are also key factors influencing market growth.

The North America region dominated the market with largest share in 2022

North America is estimated to account for largest share in 2022. This growth can be attributed to the need to counter the rising terrorist activities and the consequent implementation of various military equipment modernization programs expected to propel major defense manufacturers of the region to develop more techno-efficient directed energy weapons.

The North American directed energy weapons market includes US and Canada. US contributed the largest share to the directed energy weapons market in 2022 due to the increased demand for high-energy laser systems and high-power microwave systems in the country on its military bases in overseas deployment. This region is expected to witness a significant increase in research & development activities, particularly in high-energy laser system technologies.

The break-up of the profiles of primary participants in the directed energy weapon market is as follows:

- By Company Type: Tier 1–35%; Tier 2–45%; and Tier 3–20%

- By Designation: C Level Executives–35%; Directors–25%; and Others–40%

- By Region: Asia Pacific–30%; North America–40%; Europe–20%; and Rest of the World–10%

Research Coverage

This research report categorizes classified the directed energy weapon market into platform, application, range, technology, product, and region. The directed energy weapon market has been studied for North America, Europe, Asia Pacific, and Rest of the World.

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the directed energy weapon market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches associated with the directed energy weapon market. Competitive analysis of upcoming startups in the directed energy weapon market ecosystem is covered in this report.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall directed energy weapon market and its segments. This study is also expected to provide platform-wise information, wherein different DEW technology is used for different platforms. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on directed energy weapon system offered by the top players in the market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product and services launches in the directed energy weapon market.

- Market Development: Comprehensive information about lucrative markets – the report analyzes the directed energy weapon market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the directed energy weapon market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the directed energy weapon market

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 DIRECTED ENERGY WEAPONS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.3.3 REGIONAL SCOPE

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 DIRECTED ENERGY WEAPONS MARKET: INCLUSIONS AND EXCLUSIONS

1.5 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES

1.6 MARKET STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

FIGURE 2 RESEARCH PROCESS FLOW

FIGURE 3 DIRECTED ENERGY WEAPONS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Key data from primary sources

2.1.2.3 Primary sources

2.1.2.4 Breakdown of primaries

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 IMPACT OF RECESSION ON DIRECTED ENERGY WEAPONS MARKET

FIGURE 5 RECESSION IMPACT ON REVENUE OF KEY PLAYERS

2.3 FACTOR ANALYSIS

2.3.1 INTRODUCTION

2.3.2 DEMAND-SIDE INDICATORS

2.3.2.1 Increase in military spending of emerging countries

2.3.2.2 Growth of military expenditure

FIGURE 6 MILITARY EXPENDITURE, 2019–2021

2.3.2.3 Rising incidences of regional disputes, terrorism, and political conflicts

2.3.3 SUPPLY-SIDE INDICATORS

2.3.3.1 Financial trend of major US defense contractors

2.4 RESEARCH APPROACH AND METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.1.1 Market size estimation

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 TRIANGULATION AND VALIDATION

2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

FIGURE 9 DATA TRIANGULATION

2.6 RESEARCH ASSUMPTIONS

FIGURE 10 ASSUMPTIONS FOR RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY

FIGURE 11 HIGH ENERGY LASER SEGMENT TO HOLD HIGHEST MARKET SHARE IN 2022

FIGURE 12 MILITARY SEGMENT TO LEAD MARKET FROM 2022 TO 2027

FIGURE 13 AIRBORNE SEGMENT TO RECORD HIGHEST GROWTH BY 2027

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN DIRECTED ENERGY WEAPONS MARKET

FIGURE 14 INCREASING TERRORIST THREATS AND HIGHLY DISPUTED BORDERS TO DRIVE MARKET

4.2 DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY

FIGURE 15 HIGH ENERGY LASER SEGMENT EXPECTED TO LEAD DIRECTED ENERGY WEAPONS MARKET FROM 2022 TO 2027

4.3 DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM

FIGURE 16 NAVAL SEGMENT PROJECTED TO GAIN MAJOR MARKET SHARE DURING FORECAST PERIOD

4.4 DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT

FIGURE 17 LETHAL WEAPONS SEGMENT TO ACCOUNT FOR MOST SIGNIFICANT MARKET SHARE FROM 2022 TO 2027

4.5 DIRECTED ENERGY WEAPONS MARKET, BY REGION

FIGURE 18 NORTH AMERICA LED MARKET IN 2022

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DIRECTED ENERGY WEAPONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased demand in combat operations

5.2.1.2 Modernization and investments in military platforms

5.2.1.3 Rapid advancements in AI, big data analytics, and robotics

5.2.1.4 Development of compact DEW for UAV platforms

5.2.2 RESTRAINTS

5.2.2.1 Restrictions on anti-personnel lasers

5.2.2.2 Utilization of DEW for law enforcement missions

5.2.2.3 Possibility of high collateral damage

5.2.3 OPPORTUNITIES

5.2.3.1 R&D in advanced DEW technologies

5.2.3.2 Complexities in weapon development

5.2.4 CHALLENGES

5.2.4.1 Increased barriers in designing military DEW systems

5.2.4.2 Integrating existing systems with new technologies

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DIRECTED ENERGY WEAPON MANUFACTURERS

FIGURE 21 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DIRECTED ENERGY WEAPON MANUFACTURERS

5.5 DIRECTED ENERGY WEAPONS MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 APPLICATION

FIGURE 22 MARKET ECOSYSTEM MAP: DIRECTED ENERGY WEAPONS MARKET

TABLE 3 DIRECTED ENERGY WEAPONS MARKET ECOSYSTEM

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 DIRECTED ENERGY WEAPONS: PORTER’S FIVE FORCE ANALYSIS

FIGURE 23 FIVE FORCES ANALYSIS FOR DIRECTED ENERGY WEAPONS MARKET

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 RECESSION IMPACT ANALYSIS

5.7.1 IMPACT OF RECESSION ON DIRECTED ENERGY WEAPONS MARKET

FIGURE 24 FACTORS IMPACTING DIRECTED ENERGY WEAPONS MARKET

FIGURE 25 SCENARIO ANALYSIS OF DIRECTED ENERGY WEAPONS MARKET

5.8 REGULATORY LANDSCAPE

5.8.1 NORTH AMERICA

5.8.2 EUROPE

5.8.3 ASIA PACIFIC

5.9 TRADE ANALYSIS

TABLE 5 ELECTRICAL MACHINES AND APPARATUS: COUNTRY-WISE IMPORTS, 2020–2021 (USD THOUSAND)

TABLE 6 ELECTRICAL MACHINES AND APPARATUS: COUNTRY-WISE EXPORTS, 2020–2021 (USD THOUSAND)

5.10 AVERAGE SELLING PRICE TREND

TABLE 7 DIRECTED ENERGY WEAPONS MARKET: AVERAGE SELLING PRICE TREND

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE TECHNOLOGIES

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE TECHNOLOGY TYPES (%)

5.11.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 9 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.12 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 10 DIRECTED ENERGY WEAPONS MARKET: CONFERENCES AND EVENTS

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 HIGH ENERGY MICROWAVES

6.2.2 LASER BEAM ENERGY

6.2.3 PARTICLE BEAM ENERGY

6.2.4 ACTIVE DENIAL SYSTEMS

6.3 TECHNOLOGY ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.4.1 ARMY DIRECTED ENERGY WEAPONS

6.4.2 SOLID-STATE LASERS TO COUNTER UNMANNED AERIAL VEHICLES

6.4.3 DIRECTED ENERGY WEAPONS FOR SPACE AND SATELLITE SECURITY

6.5 INNOVATION AND PATENT REGISTRATIONS

TABLE 11 IMPORTANT INNOVATION AND PATENT REGISTRATIONS, 2007–2022

6.6 USE CASE ANALYSIS: DIRECTED ENERGY WEAPONS MARKET

6.6.1 TACTICAL HIGH ENERGY LASER BY NORTHROP GRUMMAN OFFERS VIABLE DEFENSE AGAINST THREATS

6.6.2 TURKEY BECAME FIRST COUNTRY TO USE DIRECTED ENERGY WEAPONS IN COMBAT

6.6.3 GERMAN NAVY INTEGRATES HIGH ENERGY LASER ON FRIGATE AND SHOOTS DOWN DRONE

7 DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY

7.1 INTRODUCTION

FIGURE 28 HIGH ENERGY LASER SEGMENT PROJECTED TO LEAD DIRECTED ENERGY WEAPONS MARKET DURING FORECAST PERIOD

TABLE 12 DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 13 DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

7.2 HIGH ENERGY LASER

7.2.1 SOLID-STATE LASER

7.2.1.1 Used in numerous military applications

7.2.2 FIBER LASER

7.2.2.1 High efficiency, low maintenance, and reliable

7.2.3 FREE ELECTRON LASER

7.2.3.1 Megawatt level output for strategic missile defense

7.2.4 CHEMICAL LASER

7.2.4.1 Provides precision with destructive capability at speed of light

7.2.5 LIQUID LASER

7.2.5.1 Better performance due to continuous cooling by liquid circulation

7.3 HIGH-POWER RADIO FREQUENCY

7.3.1 NARROW-BAND MICROWAVE

7.3.1.1 Causes temporary and permanent damage to targets

7.3.2 ULTRA-WIDEBAND MICROWAVE

7.3.2.1 Increased immunity to interference due to lower spectral power density

7.4 ELECTROMAGNETIC WEAPONS

7.4.1 PARTICLE BEAM WEAPONS

7.4.1.1 Charged particle beam weapons

7.4.1.1.1 Cause near-instantaneous and catastrophic superheating of surfaces

7.4.1.2 Neutral particle beam weapons

7.4.1.2.1 Use electrically neutral beam of high-energy hydrogen atoms for targets

7.4.2 LASER-INDUCED PLASMA CHANNELS (LIPC)

7.4.2.1 Equally powerful as lightning during storms

7.5 SONIC WEAPONS

7.5.1 FOCUSED BEAM OF SOUND TO DAMAGE TARGET

8 DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION

8.1 INTRODUCTION

FIGURE 29 MILITARY SEGMENT TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

TABLE 14 DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 15 DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 HOMELAND SECURITY

8.2.1 GROWING DEMAND IN MINING SECTOR OWING TO LONGER FLIGHT TIME

8.2.2 RIOT CONTROL

8.2.2.1 Development of advanced, non-lethal weapons for riot control

8.2.3 AIRPORT PROTECTION

8.2.3.1 Safeguards airports from incoming missiles, mortars, anti-aircraft missiles, drones, and other threats

8.2.4 ANTI-DRUG SMUGGLING

8.2.4.1 Helps control creative and new technologies from smuggling drugs across borders

8.2.5 CRITICAL INFRASTRUCTURE PROTECTION

8.2.5.1 Ground-based laser weapons protect critical infrastructure from terrorist attacks

8.2.6 CHEMICAL, BIOLOGICAL, RADIOLOGICAL, NUCLEAR, AND EXPLOSIVES (CBRNE) DEFENSE

8.2.6.1 High-energy lasers to intercept ballistic and nuclear missiles

8.3 MILITARY

8.3.1 BORDER PROTECTION

8.3.1.1 Demand for better intelligence, force modernization, and meeting equipment needs

8.3.2 TACTICAL MISSILE DEFENSE

8.3.2.1 Defend against nuclear-armed ICBMs, shorter-ranged non-nuclear tactical, and theater missiles

8.3.3 MARITIME PROTECTION

8.3.3.1 Defend sea-skimming cruise missiles

8.3.4 MILITARY BASE PROTECTION

8.3.4.1 Strategic positioning to defend military bases against incoming threats

8.3.5 ANTI-BALLISTIC MISSILE DEFENSE

8.3.5.1 High-performance tactical missile defense systems to influence military force deployment strategies

8.3.6 ANTI-SATELLITE DEFENSE

8.3.6.1 High-energy beams to kill or destroy satellites

8.3.7 COMMAND, CONTROL, AND INFORMATION WARFARE

8.3.7.1 High-power electromagnetic weapons to disable electronics of command and communication systems

8.3.8 BATTLEFIELD AIR INTERDICTION

8.3.8.1 Involves air attacks affecting ground combat

8.3.9 CLOSE AIR SUPPORT (CAS)

8.3.9.1 High speed and range, accuracy, and limited collateral damage

9 DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM

9.1 INTRODUCTION

FIGURE 30 NAVAL SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

TABLE 16 DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 17 DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

9.2 LAND

9.2.1 ARMORED VEHICLES

9.2.1.1 Combat vehicles

9.2.1.1.1 Easy installation of directed energy weapons

9.2.1.2 Combat support vehicles

9.2.1.2.1 Assist main combat vehicles

9.2.1.3 Unmanned armored ground vehicles

9.2.1.3.1 Operates without human presence onboard

9.2.2 HANDHELD

9.2.2.1 Compact, lightweight, and energy-efficient weapons

9.2.3 WEAPON SYSTEMS

9.2.3.1 Launch systems

9.2.3.1.1 Demand for precision targeting and attack

9.2.3.2 Defense systems

9.2.3.2.1 Demand for low-cost alternative to interceptor rockets

9.3 AIRBORNE

9.3.1 HELICOPTERS

9.3.1.1 Low cost of engagement and easy installation

9.3.2 FIGHTER AIRCRAFT

9.3.2.1 Developed by major market players

9.3.3 SPECIAL MISSION AIRCRAFT

9.3.3.1 Offers high precision strike ability

9.3.4 TACTICAL UAVS

9.3.4.1 Low equipment size, weight, and power consumption

9.4 NAVAL

9.4.1 COMBAT SHIPS

9.4.1.1 Fast, maneuverable, and long endurance

9.4.2 SUBMARINES

9.4.2.1 Ability to penetrate below-water surfaces without attenuation

9.4.3 UNMANNED SURFACE VEHICLES

9.4.3.1 Used for MCM, ISR, and ASW

9.5 SPACE

9.5.1 SATELLITES

9.5.1.1 Assist in strategic and tactical missions

9.5.2 SPACE-BASED INTERCEPTORS

9.5.2.1 Low reaction time and high attack speed

9.5.3 EARTH TO SPACE WEAPONS

9.5.3.1 Suitable for space security and preparedness

10 DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT

10.1 INTRODUCTION

FIGURE 31 LETHAL WEAPONS SEGMENT TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

TABLE 18 DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 19 DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

10.2 LETHAL WEAPONS

10.2.1 RAIL GUNS

10.2.1.1 Cause damage to targets by firing projectile with high speed, mass, and kinetic energy

10.2.2 ELECTROMAGNETIC BOMBS

10.2.2.1 Ability to destroy electronic systems

10.2.3 PLASMA CANNON

10.2.3.1 Uses plasma discharge instead of chemical propellants

10.2.4 MICROWAVE GUNS

10.2.4.1 Generate very high power levels of repeated short pulses and very little heat

10.2.5 NAVY LASER CANNON

10.2.5.1 Counters surface craft and UAVs

10.2.6 GUN LAUNCHED GUIDED PROJECTILE

10.2.6.1 Next-generation, low drag system

10.3 NON-LETHAL WEAPONS

10.3.1 PULSED ENERGY PROJECTILE

10.3.1.1 Can be used for riot control

10.3.2 ACTIVE DENIAL SYSTEMS (ADS)

10.3.2.1 Fires high-powered beam of 95 GHz waves at targets

10.3.3 DAZZLERS

10.3.3.1 Uses intense directed radiation to disable targets temporarily

10.3.4 SONIC GUNS

10.3.4.1 Fire extremely high-power sound waves to damage or destroy eardrums

10.3.5 TASER GUNS

10.3.5.1 Disrupts voluntary control of muscles

10.3.6 STUN GUNS

10.3.6.1 Not preferred by law enforcement agents

11 DIRECTED ENERGY WEAPONS MARKET, BY RANGE

11.1 INTRODUCTION

FIGURE 32 MORE THAN 1 KM SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

TABLE 20 DIRECTED ENERGY WEAPONS MARKET, BY RANGE, 2019–2021 (USD MILLION)

TABLE 21 DIRECTED ENERGY WEAPONS MARKET, BY RANGE, 2022–2027 (USD MILLION)

11.2 LESS THAN 1 KM

11.2.1 SOLID-STATE LASERS OFFER BETTER PERFORMANCE IN LESS THAN 1 KM RANGE

11.3 MORE THAN 1 KM

11.3.1 OFFERS DEFENSE AGAINST MULTIPLE THREATS

12 REGIONAL ANALYSIS

12.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: GROWTH RATE ANALYSIS, 2022–2027

12.2 REGIONAL RECESSION IMPACT ANALYSIS

12.2.1 SMALL AND MEDIUM-SIZED BUSINESSES IN DEFENSE MARKET

12.2.2 RUSSIA-UKRAINE EFFECT

TABLE 22 REGIONAL RECESSION IMPACT ANALYSIS

TABLE 23 DIRECTED ENERGY WEAPONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 24 DIRECTED ENERGY WEAPONS MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 NORTH AMERICA

12.3.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 34 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET SNAPSHOT

TABLE 25 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 26 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 27 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 28 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 29 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 30 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 31 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 32 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 33 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 34 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.2 US

12.3.2.1 Strong focus on development and procurement of modern military weapon systems

TABLE 35 US: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 36 US: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 37 US: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 38 US: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 39 US: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 40 US: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 41 US: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 42 US: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.3.3 CANADA

12.3.3.1 Increased R&D investments

TABLE 43 CANADA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 44 CANADA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 45 CANADA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 46 CANADA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.4 EUROPE

12.4.1 PESTLE ANALYSIS: EUROPE

FIGURE 35 EUROPE: DIRECTED ENERGY WEAPONS MARKET SNAPSHOT

TABLE 47 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 48 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 49 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 50 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 51 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 52 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 53 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 54 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 55 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 56 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.2 RUSSIA

12.4.2.1 Constant focus on strengthening military power with advanced weapon systems

TABLE 57 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 58 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 59 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 60 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 61 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 62 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 63 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 64 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.4.3 FRANCE

12.4.3.1 Presence of key players with strong product innovation and development capabilities

TABLE 65 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 66 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 67 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 68 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 69 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 70 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 71 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 72 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.4.4 GERMANY

12.4.4.1 High demand for lethal and non-lethal weapons to improve capabilities of military platform

TABLE 73 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 74 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 75 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 76 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 77 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 78 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 79 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 80 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.4.5 UK

12.4.5.1 Market expansion through significant investment in military system development programs

TABLE 81 UK: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 82 UK: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 83 UK: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 84 UK: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 85 UK: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 86 UK: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 87 UK: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 88 UK: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.4.6 ITALY

12.4.6.1 High investment by key players in R&D

TABLE 89 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 90 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 91 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 92 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 93 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 94 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 95 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 96 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.4.7 REST OF EUROPE

12.4.7.1 Significant improvement and strengthening of military capabilities

TABLE 97 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 98 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 99 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 100 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 101 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 102 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 103 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 104 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.5 ASIA PACIFIC

12.5.1 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 36 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET SNAPSHOT

TABLE 105 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 106 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 107 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 108 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 109 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 110 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 114 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.2 CHINA

12.5.2.1 Increasing investment to strengthen military

TABLE 115 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 116 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 117 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 118 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 119 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 120 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 121 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 122 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.5.3 INDIA

12.5.3.1 Increasing procurement and development of advanced military platforms and systems to tackle border disputes

TABLE 123 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 124 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 125 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 126 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 127 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 128 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 129 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 130 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.5.4 JAPAN

12.5.4.1 Rising focus on innovation of high-end indigenous military technologies

TABLE 131 JAPAN: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 132 JAPAN: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 133 JAPAN: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 134 JAPAN: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.5.5 SOUTH KOREA

12.5.5.1 Boost to military capabilities with development of lethal and non-lethal weapons systems

TABLE 135 SOUTH KOREA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 136 SOUTH KOREA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 137 SOUTH KOREA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 138 SOUTH KOREA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.5.6 AUSTRALIA

12.5.6.1 Supportive government programs to modernize military weapons

TABLE 139 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 140 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 141 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 142 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 143 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 144 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 145 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 146 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.5.7 REST OF ASIA PACIFIC

12.5.7.1 Deployment of technologically advanced military platforms on battlefields

TABLE 147 REST OF ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 148 REST OF ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 149 REST OF ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.6 REST OF THE WORLD

12.6.1 PESTLE ANALYSIS: REST OF THE WORLD

TABLE 151 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 152 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 153 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 154 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 155 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 156 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 157 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 158 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 159 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 160 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.2 ISRAEL

12.6.2.1 Presence of major defense players

TABLE 161 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 162 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 163 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 164 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 165 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 166 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 167 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 168 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12.6.3 TURKEY

12.6.3.1 Increasing number of terror attacks led to procurement of modern weapon systems

TABLE 169 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 170 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 171 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 172 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 173 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 174 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 175 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 176 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

13.1 INTRODUCTION

13.2 COMPANY OVERVIEW

13.2.1 KEY DEVELOPMENTS/STRATEGIES OF LEADING PLAYERS IN DIRECTED ENERGY WEAPONS MARKET

13.3 RANKING ANALYSIS OF KEY PLAYERS IN DIRECTED ENERGY WEAPONS MARKET, 2021

FIGURE 37 RANKING OF KEY PLAYERS IN DIRECTED ENERGY WEAPONS MARKET, 2021

13.4 REVENUE ANALYSIS, 2021

FIGURE 38 REVENUE ANALYSIS OF KEY COMPANIES IN DIRECTED ENERGY WEAPONS MARKET, 2018-2021

13.5 MARKET SHARE ANALYSIS, 2021

FIGURE 39 DIRECTED ENERGY WEAPONS MARKET SHARE ANALYSIS OF KEY COMPANIES, 2021

TABLE 177 DIRECTED ENERGY WEAPONS MARKET: DEGREE OF COMPETITION

13.6 COMPETITIVE EVALUATION QUADRANT

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 40 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

13.7 STARTUP/SME EVALUATION QUADRANT

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.7.4 STARTING BLOCKS

FIGURE 41 DIRECTED ENERGY WEAPONS MARKET (STARTUP/SME) COMPETITIVE LEADERSHIP MAPPING, 2021

13.8 COMPETITIVE BENCHMARKING

TABLE 178 COMPANY FOOTPRINT (25 COMPANIES)

TABLE 179 COMPANY PRODUCT FOOTPRINT

TABLE 180 COMPANY APPLICATION FOOTPRINT

TABLE 181 COMPANY REGION FOOTPRINT

13.9 COMPETITIVE SCENARIO

13.9.1 MARKET EVALUATION FRAMEWORK

TABLE 182 PRODUCT LAUNCHES, SEPTEMBER 2020–SEPTEMBER 2022

TABLE 183 DEALS, NOVEMBER 2018–JANUARY 2023

TABLE 184 OTHERS, SEPTEMBER 2018–JULY 2022

14 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 LOCKHEED MARTIN CORPORATION

TABLE 185 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

FIGURE 42 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 186 LOCKHEED MARTIN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 187 LOCKHEED MARTIN CORPORATION: DEALS

14.2.2 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 188 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 43 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 189 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 190 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

TABLE 191 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

TABLE 192 RAYTHEON TECHNOLOGIES CORPORATION: OTHERS

14.2.3 NORTHROP GRUMMAN CORPORATION

TABLE 193 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 44 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 194 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 195 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

TABLE 196 NORTHROP GRUMMAN CORPORATION: DEALS

TABLE 197 NORTHROP GRUMMAN CORPORATION: OTHERS

14.2.4 THALES GROUP

TABLE 198 THALES GROUP: BUSINESS OVERVIEW

FIGURE 45 THALES GROUP: COMPANY SNAPSHOT

TABLE 199 THALES GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 200 THALES GROUP: DEALS

14.2.5 BAE SYSTEMS PLC

TABLE 201 BAE SYSTEMS PLC: BUSINESS OVERVIEW

FIGURE 46 BAE SYSTEMS PLC: COMPANY SNAPSHOT

TABLE 202 BAE SYSTEMS PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 203 BAE SYSTEMS PLC: PRODUCT LAUNCHES

TABLE 204 BAE SYSTEMS PLC: DEALS

TABLE 205 BAE SYSTEMS PLC: OTHERS

14.2.6 THE BOEING COMPANY

TABLE 206 THE BOEING COMPANY: BUSINESS OVERVIEW

FIGURE 47 THE BOEING COMPANY: COMPANY SNAPSHOT

TABLE 207 THE BOEING COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 208 THE BOEING COMPANY: PRODUCT LAUNCHES

TABLE 209 THE BOEING COMPANY: DEALS

14.2.7 TEXTRON, INC.

TABLE 210 TEXTRON, INC.: BUSINESS OVERVIEW

FIGURE 48 TEXTRON, INC.: COMPANY SNAPSHOT

TABLE 211 TEXTRON, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

14.2.8 RHEINMETALL AG

TABLE 212 RHEINMETALL AG: BUSINESS OVERVIEW

FIGURE 49 RHEINMETALL AG: COMPANY SNAPSHOT

TABLE 213 RHEINMETALL AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 214 RHEINMETALL AG: PRODUCT LAUNCHES

TABLE 215 RHEINMETALL AG: DEALS

14.2.9 L3HARRIS TECHNOLOGIES, INC.

TABLE 216 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 50 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 217 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 218 L3HARRIS TECHNOLOGIES, INC.: DEALS

14.2.10 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

TABLE 219 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: BUSINESS OVERVIEW

FIGURE 51 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 220 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 221 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: DEALS

14.2.11 MOOG, INC.

TABLE 222 MOOG, INC.: BUSINESS OVERVIEW

FIGURE 52 MOOG, INC.: COMPANY SNAPSHOT

TABLE 223 MOOG, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 224 MOOG, INC.: OTHERS

14.2.12 QINETIQ LIMITED

TABLE 225 QINETIQ LIMITED: BUSINESS OVERVIEW

FIGURE 53 QINETIQ LIMITED: COMPANY SNAPSHOT

TABLE 226 QINETIQ LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 227 QINETIQ LIMITED: DEALS

14.2.13 HONEYWELL INTERNATIONAL INC.

TABLE 228 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 54 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 229 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

14.2.14 ELBIT SYSTEMS LTD.

TABLE 230 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

FIGURE 55 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 231 ELBIT SYSTEMS LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 232 ELBIT SYSTEMS LTD.: DEALS

14.2.15 LEONARDO SPA

TABLE 233 LEONARDO SPA: BUSINESS OVERVIEW

FIGURE 56 LEONARDO SPA: COMPANY SNAPSHOT

TABLE 234 LEONARDO SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 235 LEONARDO SPA: DEALS

14.3 OTHER PLAYERS

14.3.1 DYNETICS, INC.

TABLE 236 DYNETICS, INC.: COMPANY OVERVIEW

14.3.2 EAGLEPICHER TECHNOLOGIES

TABLE 237 EAGLEPICHER TECHNOLOGIES: COMPANY OVERVIEW

14.3.3 RADIANCE TECHNOLOGIES, INC.

TABLE 238 RADIANCE TECHNOLOGIES, INC.: COMPANY OVERVIEW

14.3.4 APPLIED RESEARCH ASSOCIATES, INC.

TABLE 239 APPLIED RESEARCH ASSOCIATES, INC.: COMPANY OVERVIEW

14.3.5 BLUEHALO

TABLE 240 BLUEHALO: COMPANY OVERVIEW

14.3.6 ROKETSAN AS

TABLE 241 ROKETSAN AS: COMPANY OVERVIEW

14.3.7 GENERAL ATOMICS

TABLE 242 GENERAL ATOMICS: COMPANY OVERVIEW

14.3.8 MBDA

TABLE 243 MBDA: COMPANY OVERVIEW

14.3.9 EPIRUS, INC.

TABLE 244 EPIRUS, INC.: COMPANY OVERVIEW

14.3.10 AQWEST LLC

TABLE 245 AQWEST LLC: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

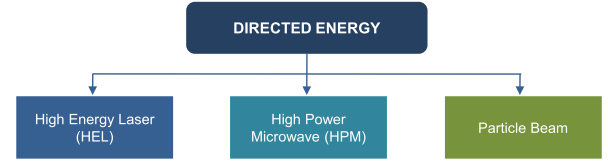

Directed Energy Weapons (DEWs) transmit energy instead of matter. They have non-zero time of flight compared to conventional ordnance, which allow longer decision times and quicker reaction times. Directed energy weapons are mainly categorized as High Energy Laser (HELs), particle beam, and High Power Microwave (HPM) weapons. Further, HEL weapons are categorized into three technologies, namely chemical lasers, fiber lasers, and Free Electron Lasers (FELs).

The global directed energy weapons market is anticipated to grow at a CAGR of 26.2% by 2020. It is a highly lucrative market and estimated to rise from $4.55 billion in 2014 to $18.42 billion by 2020. The market began to grow from 1930s when the Nazis investigated X-ray beams and built an electron accelerator called Rheotron during World War II. Also, in 2003, the U.S. military used high power microwaves in the Iraq War to disrupt and destroy Iraq’s electronic systems.

Directed Energy Weapons Segmentation, By Technology

The table above illustrates the market values for all three technologies of DEWs from the period of 2013 to 2020. The High Energy Laser (HEL) technology is estimated to have the highest CAGR of XX followed by High Power Microwave (HPM), with a CAGR of XX. The U.S. Air Force and Navy are focusing toward HEL weapons rather than HPM, due to the major differences of precision and lethality between them, Particle beam technology is estimated to register growth at a CAGR of XX. Particle beam weapons are spaced-based systems and cannot be penetrated through the atmosphere, so the weapons invented with this technology need to be based in space and are hence rarely used.

Directed energy weapons have two major applications-defense and homeland security. Amongst these applications, defense is the major field where DEWs are more functional. DEWs are being used for defense from the 1930s. Lethal products are used for defense applications whereas, non-lethal are used for homeland security. Recently, products such as laser dazzlers, car stopping microwave systems, Pulsed Energy projectile (PEP) systems, and several others are being used for homeland security. There have been huge investments in DEWs for defense application from several years. It is anticipated that the DEW market will be dominated by products in defense application in the coming years.

North America accounts for XX of the total DEW market in 2013. It is estimated that Middle East will register the highest CAGR of XX from 2014 to 2020, followed by Latin America and Asia-Pacific. It is anticipated that Middle East and APAC are showing maximum inclination towards the defense sector and ultimately will have highest procurements in DEW till 2020. Due to the declining economic conditions in North America, it has decreased its defense budget of 2014 with a possibility of further reduction in the future, which will ultimately impact its market till 2020.